CASH VS NON-CASH REWARDS

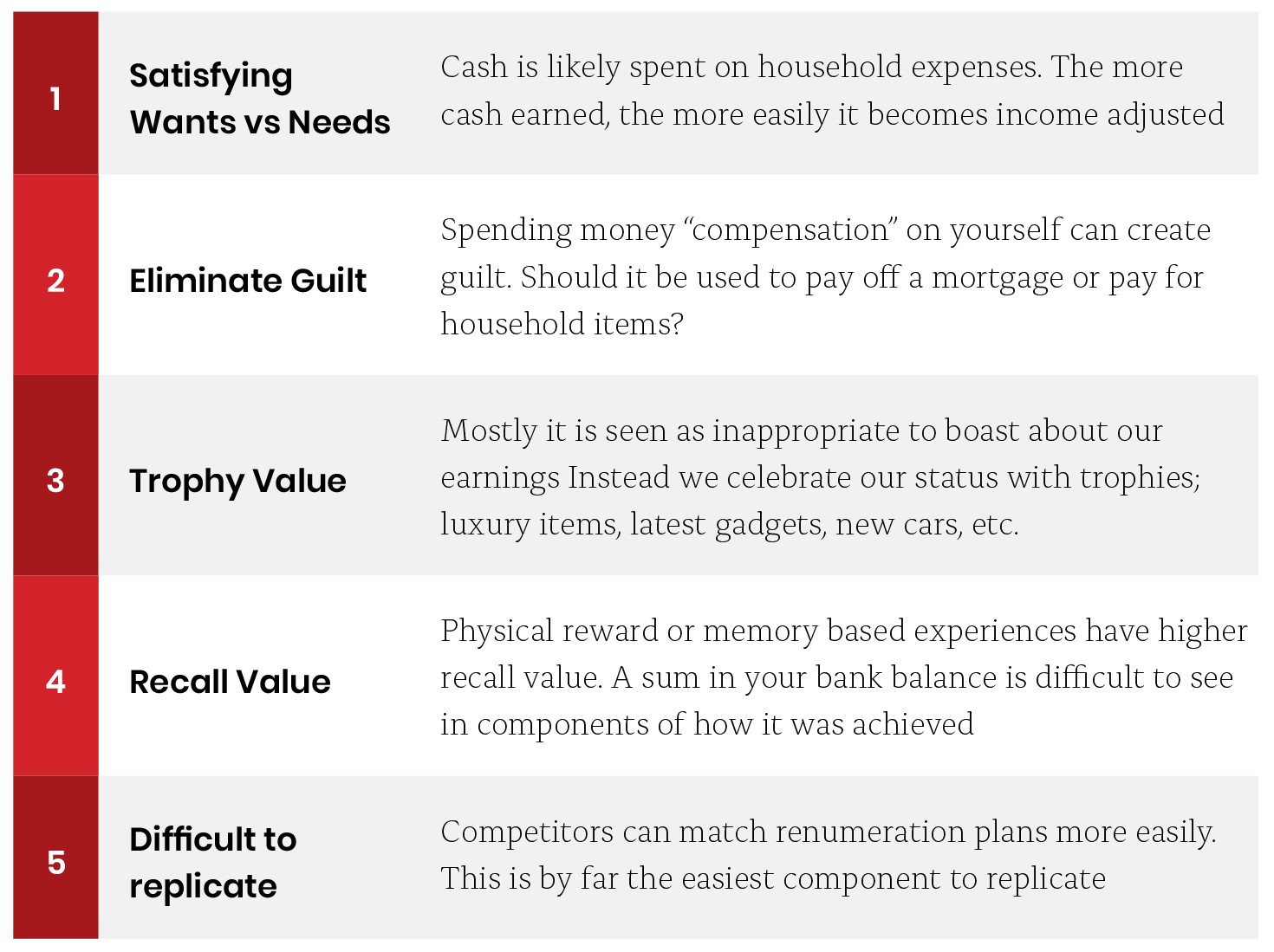

One of our core philosophies for B2B program design centres on the inclusion of non-cash rewards or incentives to change behaviour. We often discuss the role of cash vs non-cash rewards with clients and the best ways to use each. Cash rewards have a number of things going for them:

• They’re simple to understand

• They’re easy to distribute

• Cash has a universal value

However, the million-dollar question is: Will an increase in cash change behaviour the way you want it to?

Money is a critical component of an individual or channel partner relationship, but it’s often the wrong instrument when trying to change behaviour. If it’s really a “global” solution to every organisational challenge, then shouldn’t everyone be on commission-based packages and outperforming expectations?

But let’s dig into this, starting with the roles of compensation vs incentives. Compensation’s role is to attract and retain the right calibre of people or distribution partners and get them to deliver on business objectives. Once an individual or channel distributor receives compensation, it often becomes taken for granted.

In other words, you’ll face a struggle to “rearrange” the situation… and find it almost impossible to take away or reduce. However, from a rewards perspective, incentives are a different creature. This definition of non-cash rewards sums it up nicely.

Going further, the notion of severability is a powerful influencer in a non-cash model. Severability combines several of the attributes above and frames the concept that non-cash rewards remain “separate” from household income.

We’ve all used frequent flyer points to upgrade a flight, or credit card points to buy a new watch, bag, or tablet… whatever you’ve fancied at the time.

We do this guilt-free because those points are severable. Redemptions or point purchases don’t need to be justified to the same extent as money, as household income is untouched.

Having said all that, there are times where cash may be a better option than non-cash rewards. After all, everything has its place.

Imagine a budget of around $12,500 per person for an incentive trip. As you can imagine that kind of money makes for an amazing travel incentive experience.

Setting aside the ROI challenges for this discussion, we used our discovery process to explore and understand the target audience. We realised that 80% of the target audience were modest income earners.

That being the case, we felt the audience would be more engaged by incentives that gave them flexibility on the rewards, so they could choose what was right for them.

Imagine you were just making ends meet and were suddenly invited to travel to Monaco, all expenses paid. Sure, there might be early excitement, but then “real life” would set in and you’d probably start thinking how you’d prefer to have something more relevant to your lifestyle.

We often make comparisons to Maslow’s Hierarchy of Needs to illustrate this better. Ultimately, the channel program could not pay people’s salaries (and that is not its role), so we recommended a tiered program with a travel incentive program for some of the target audience, and either a merchandise reward program or a branded prepaid Visa card for the remaining majority.

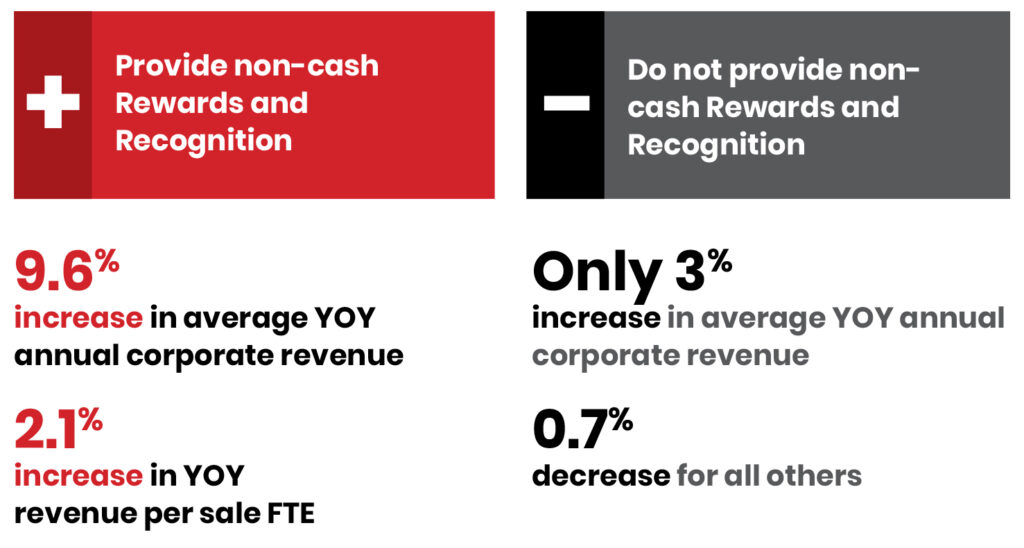

So, how do we know non-cash programs work? There are literally dozens of data sources, case studies, and research surveys showing this, from the IRF (Incentive Research Foundation), IMA (Incentive Marketing Institute), The Wise Marketer, and Aberdeen Group. They all lead to a similar conclusion: non-cash rewards have a prominent place in many incentive programs.

One study by Aberdeen Group around sales performance management uncovered a fascinating find with organisations that provided non-cash rewards against those who didn’t:

We’ve seen it ourselves with hundreds of clients over the years. Since 1996, we’ve been implementing rewards programs, learning firsthand what works and what doesn’t. And while our access to information and data has changed over the years, the fundamentals of good program design haven’t wavered.

Cash and non-cash have their place in every organisation using incentive programs. Which one is king depends on organisational objectives and how well the behavioural change plan is structured and communicated.

Ultimately, it boils down to what we tell our clients: design the right behaviour change program first, select the reward last.